Chilling the Arab Spring

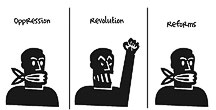

‘There appears to be very little difference in what is being advocated [by the IMF] to Arab democrats today and what was advocated to Arab dictators yesterday,’ writes Patrick Bond.

PART 1: WASHINGTON’S SEEDING OF THE ARAB DEMOCRATIC REVOLUTION

An incident two and a half years ago in Carthage spoke volumes about power politics and economic ideology. As he was given the country’s main honour, the Order of the Tunisian Republic, on account of his “contribution to the reinforcement of economic development at the global level,” International Monetary Fund Managing Director Dominique Strauss-Kahn returned the favour, offering the dictatorship of Zine El Abidine Ben Ali a warm embrace, which turned out to be the kiss of death.

“Economic policy adopted here is a sound policy and is the best model for many emerging countries,” said Strauss-Kahn. “Our discussions confirmed that we share many of the same views on Tunisia’s achievements and main challenges. Tunisia is making impressive progress in its reform agenda and its prospects are favorable.”[1]

In late May 2011, just days after Strauss-Kahn resigned in disgrace after New York police charged him with sexual predation against an African hotel cleaning worker, the IMF outlined a new set of opportunities in Tunisia and neighboring countries: “The spark ignited by the death of Mohammed Bouazizi has irretrievably changed the future course of the countries in the Middle East and North Africa (MENA). But each country will change in its own way and at its own speed. Nor will they necessarily have a common political or economic model when they reach their destination.”[2] In reality, ‘the model’ for each is indeed ‘common’ in Washington’s eyes: neoliberalism.

And moreover, there appears to be very little difference in what is being advocated to Arab democrats today and what was advocated to Arab dictators yesterday. For in September 2010, IMF Survey Magazine praised Ben Ali for his commitment “to reduce tax rates on businesses and to offset those reductions by increasing the standard Value Added Tax (VAT) rate.”[3] Mohammed Bouazizi was an informal street trader, and the police overturned his fruit cart a few weeks later, on December 27, presumably because he was not contributing to Value Added Tax with his survivalist business. (There may have been other reasons, but this is typically the rationale offered by authorities for disrupting street traders across the world.)[4]

If the IMF leadership praised the dictatorship, insisted on austerity and advocated squeezing poor people for more taxes, what business does it have today in giving similar advice to Tunisia, or anywhere in the Middle East and North Africa, or for that matter Europe or anywhere at all? What can we learn about IMF thinking in Tunisia, Egypt and Libya, as well as Palestine?

1.1 Tunisia as ‘best model’

In its 2010 Tunisia review, called an Article IV Consultation, the IMF approved Ben Ali’s policies of “enhancing its business environment and improving the competitiveness of its economy,” including a preferential trade agreement with West Africa and “free trade agreements with the Central African Economic and Monetary Community. Bilateral negotiations with the European Union are also under way to extend the Association agreement to services, agricultural products, and processed food; the agreement currently provides for free trade for industrial products.”[5]

In addition, the IMF appreciated Tunisia’s “reforms to labor market policies, the educational system, and public employment services that will serve to facilitate labor mobility.” The IMF applauded the Tunis authorities for “reforming the social security system” (i.e. cuts that might “buttress the pension system’s financial sustainability”), exploring “ways to contain subsidies of food and fuel products,” and “undertaking reforms to make the tax regime more business friendly” including commitments “to reduce tax rates on businesses and to offset those reductions by increasing the standard VAT rate” (the VAT is a consumption tax and thus explicitly regressive insofar as low-income people are hit by the state for a larger share of their income).

A further IMF objective was “consolidating the financial strength of banks, enhancing the role of banks in the economy, restructuring the public banking system, and bolstering the presence of Tunisian banks abroad. The aim, ultimately, is to transform Tunisia into a banking services hub and a regional financial market.” That in turn required “inflation targeting” (a technique to depoliticize monetarist policy especially for the purpose of raising interest rates) and “convertibility of the dinar and capital account liberalization by 2014.”

This was economic liberalization without much disguise. In contrast, there was no IMF conditionality aimed at reforming the dictatorship and halting widespread corruption by Ben Ali and his wife’s notorious Trabelsi family, or lessening the two families’ extreme level of business concentration, or ending the regime’s reliance upon murderous security forces to defend Tunisian crony capitalism, or lowering the hedonism for which Ben Ali had become famous. According to WikiLeaks, even the notoriously lax-on-dictatorship US State Department was disgusted by the consumption norms of the Ben Ali and Trabilsi families, and their control of half the national economy.[6] As Rob Prince reported,

Tunisia’s economy suffered despite World Bank/IMF claims that the country has weathered the global financial crises better than many places. Tourism was down, as were textile exports to Europe, only aggravating the already existing socioeconomic crisis. But the straw that broke the camel’s back in this case is the growing distrust and distaste among the broader population for president Ben Ali’s wife, Leila Trabelsi and her siblings, who have been scrambling to dominate whatever sectors of Tunisia’s economy they could, dominating the IMF-pressured privatisations that have marked the country’s economic transition.[7]

1.2 EGYPT

The IMF offered a strikingly similar line of argument in Egypt in its April 2010 Article IV Consultation statement, praising the Mubarak dictatorship for implementing neoliberal policies prior to the global financial meltdown, and then after a brief moment of rising budget deficits and loose monetary policy, insisting on a return to the Washington Consensus forthwith. On the one hand the IMF document complained about the crisis-induced postponement of “key fiscal reforms – introducing the property tax, broadening the VAT, and phasing out energy subsidies,” but offered an upbeat endorsement of the ruling regime:

Five years of reforms and prudent macroeconomic policies created the space needed to respond to the global financial crisis, and the supportive fiscal and monetary policies of the past year have been in line with staff’s advice. The authorities remain committed to resuming fiscal consolidation broadly in keeping with past advice to address fiscal vulnerabilities… Such adjustment will be crucial to maintain investor confidence, preserve macroeconomic stability, and create scope for future countercyclical fiscal policy.[8]

In addition to expanding Public Private Partnerships (PPPs, a euphemism for services privatization and outsourcing), the IMF named its priorities: “adopting as early as possible a full-fledged VAT, complementing energy subsidy reform with better-targeted transfers to the most needy, and containing the fiscal cost of the pension and health reforms.” Although the IMF noted just once that “Transparency International cites accountability and transparency, and weaknesses in the legal/regulatory system as key reasons for Egypt remaining 111th of 180 countries on its Corruption Perception Index,” it immediately followed this observation with a non-sequitor:

Decisive action to continue the earlier reform momentum should focus on addressing the remaining structural weaknesses. In addition to sound macroeconomic policies, efforts should focus on: Resuming privatization and increasing the role of carefully structured and appropriately priced PPPs should assist fiscal adjustment and mobilize private resources for infrastructure investment.

The word governance does not appear in the document, nor, interestingly, did the IMF express concern about Egypt’s then $32 billion foreign debt: “The composition and small size of Egypt’s external debt makes it relatively resilient to adverse external shocks.” The IMF also noted, in 2010, that “The relationship between Egypt and the World Bank Group has been transformed and markedly improved over the last few years as a result of the progress Egypt has made in implementing reforms.”

So it was that in Egypt in early 2011, just as in Tunisia, the IMF was caught flatfooted by the popular uprising and, relatedly, by the immediate problems of rapid capital flight and fiscal/financial stress that resulted. By late May 2011, in its G8 report, IMF staff had recovered and conceded,

The January revolution has raised the aspirations of Egypt’s population at a time when the economy is taking a hit from domestic unrest in the short term, the ensuing uncertainty, and large global and regional shocks (e.g., the rise in commodity prices and the violence in Libya). The political shock triggered substantial capital outflows, which in addition to the decline in tourism revenue, remittances, and exports, have led to a loss of foreign exchange reserves of about US$15 billion in the four months to end-April.[9]

In that document, IMF staff worried that “managing popular expectations and providing some short-term relief measures will be essential to maintain social cohesion in the short term,” and that this would come at a price: “external and fiscal financing gaps of US$9-12 billion… which would need to be filled with exceptional support from Egypt’s multilateral and bilateral development partners, particularly given the limited scope for adjustment in the short term.” The ‘limited scope’ reflected the breath of democracy in Egypt, but the assumption seemed to be that investments of $1 billion in debt relief (leaving $33 billion to repay) and additional grants would permit Cairo to restore good relations with Washington and to get over the hump of the democratic revolution with its ‘reform’ agenda intact.

As Adam Hanieh from London’s School of Oriental and African Studies concluded just after the G8 summit and allied Arab states pledged $15 billion to Egypt,

The plethora of aid and investment initiatives advanced by the leading powers in recent days represents a conscious attempt to consolidate and reinforce the power of Egypt’s dominant class in the face of the ongoing popular mobilizations. They are part of, in other words, a sustained effort to restrain the revolution within the bounds of an “orderly transition” – to borrow the perspicacious phrase that the U.S. government repeatedly used following the ousting of Mubarak.

At the core of this financial intervention in Egypt is an attempt to accelerate the neoliberal program that was pursued by the Mubarak regime… If successful, the likely outcome of this – particularly in the face of heightened political mobilization and the unfulfilled expectations of the Egyptian people – is a society that at a superficial level takes some limited appearances of the form of liberal democracy but, in actuality, remains a highly authoritarian neoliberal state dominated by an alliance of the military and business elites.[10]

1.3 LIBYA

The same neoliberal pro-dictator narrative was established in Libya, for example, in the IMF’s October 2010 pronouncements in which Muammar Gaddafi’s mass firing of 340 000 civil servants was celebrated: “About a quarter have reportedly found other sources of income and are no longer receiving transfers from the state budget. The mission recommends that the retrenchment program be accelerated.”[11]

The IMF’s last full Article IV Consultation for Libya was published on February 15, 2011, just before civil war broke out. Implying that Gaddafi was safe from the Arab Spring, the IMF noted that “Recent developments in neighboring Egypt and Tunisia have had limited economic impact on Libya so far,” and flattered Tripoli on a variety of fronts:

An ambitious program to privatize banks and develop the nascent financial sector is underway… Structural reforms in other areas have progressed. The passing in early 2010 of a number of far-reaching laws bodes well for fostering private sector development and attracting foreign direct investment… Executive Directors agreed with the thrust of the staff appraisal. They welcomed Libya’s strong macroeconomic performance and the progress on enhancing the role of the private sector and supporting growth in the non-oil economy. The fiscal and external balances remain in substantial surplus and are expected to strengthen further over the medium term, and the outlook for Libya’s economy remains favorable (emphasis added).[12]

This optimistic report and others like it annoyed two New York Times reporters:

Less than two weeks ago, the IMF’s executive board, its highest authority, assessed a North African country’s economy and commended its government for its “ambitious reform agenda.” The IMF also welcomed its “strong macroeconomic performance and the progress on enhancing the role of the private sector,” and “encouraged” the authorities to continue on that promising path. By unfortunate timing, that country was Libya. The fund’s mission to Tripoli had somehow omitted to check whether the “ambitious” reform agenda was based on any kind of popular support. Libya is not an isolated case. And the IMF doesn’t look good after it gave glowing reviews to many of the countries shaken by popular revolts in recent weeks.[13]

Read the full report (10,429 words) [PDF">.

* This article was first published by the Rosa Luxebourg Foundation Palestine.

* This report follows a week of consultation in Gaza and the West Bank (16-22 May 2011) while based at TIDA-Gaza, during which a great many Palestinians and TIDA staff were generous with their hospitality, time and insights. The author also thanks the Rosa Luxemburg Foundation in Ramallah for covering expenses.

* Patrick Bond is director of the University of KwaZulu-Natal Centre for Civil Society (on sabbatical at University of California-Berkeley Department of Geography).

* Please send comments to editor[at]pambazuka[dot]org or comment online at Pambazuka News.

NOTES

[1] See the reports at http://euobserver.com/9/31663

[2] International Monetary Fund (2011), “Economic Transformation in MENA: Delivering on the Promise of Shared Prosperity,” Paper presented to the G8 Summit, Deauville, France, May 27.

[3] Toujas-Bernate, J. and R.Bhattacharya (2010), “Tunisia Weathers Crisis Well, But Unemployment Persists”, Washington, IMF Middle East and Central Asia Department, 10 September, http://www.imf.org/external/pubs/ft/survey/so/2010/car091010a.htm Unless otherwise stated, the subsequent quotes are from this summary of the Article IV Consultation.

[4] http://www.streetnet.org

[5] International Monetary Fund (2010), “Tunisia: 2010 Article IV Consultation”, IMF Country Report No. 10/282, Washington, September. All quotes in this section are from this document.

[6] Cole, J. (2011), “New Wikileaks: US Knew Tunisian Government Rotten Corrupt, Supported Ben Ali Anyway,” Informed Comment blog, 16 January, http://www.juancole.com/2011/01/new-wikileaks-us-knew-tunisian-gov-rotten-corrupt-supported-ben-ali-anyway.html

[7] Prince, R. (2011), unpublished paper, Boulder, Colorado.

[8] International Monetary Fund (2010), “Arab Republic of Egypt: 2010 Article IV Consultation”, IMF Country Report No. 10/94, Washington, April. All quotes in this section are from this document.

[9] International Monetary Fund, “Economic Transformation in MENA,” op cit.

[10] Hanieh, A. (2011), ‘Egypt’s Orderly Transition? International Aid and the Rush to Structural Adjustment,’ Links, 28 May, http://links.org.au/node/2342

[11] International Monetary Fund (2010), “The Socialist People’s Libyan Arab Jamahiriya – 2010 Article IV Consultation, Preliminary Conclusions of the Mission”, Washington, 28 October.

[12] International Monetary Fund (2011), “The Socialist People’s Libyan Arab Jamahiriya – Article IV Consultation”, Washington, 15 February.

[13] Briancon, P. and J.Foley (2011), “IMF Reviews Praised Libya, Egypt and Other Nations,” New York Times, 22 February, http://www.nytimes.com/2011/02/23/business/23views.html?_r=1