South Africans peer down Trump’s world economic $#!thole

South Africa has just witnessed two major economic events, which spoke volumes about the prospects for global and local capitalism: an austerity-oriented budgetleaving the economy far more vulnerable to renewed world financial chaos; and a sham investment conferencefeaturing capitalists with just as strong a record of super-exploitation and deceit as those who went to Mohammed bin Salman’sin Riyadh the week before.

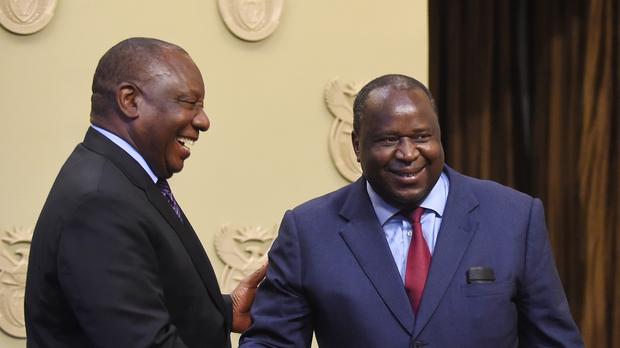

The African National Congress (ANC) government’s new Finance Minister, Tito Mboweni, has long been celebrated in the financial markets for a long-standing commitment to neoliberalism. On 9 October he replaced Nhlanhla Nene because Nene had lied about numerous meetings with the notorious Gupta brothers. Thanks to their patronage of former President Jacob Zuma (who served 2009-18), the three Indian immigrants had established a kickback networkworth billions of dollars over the prior decade, implicating major multinational corporations like KPMG.

Ironically, Nene had in 2015 resisted authorising debt for a US $100 billion Russian nuclear energy deal the Guptas favoured, as they owned the largest uranium mining house. As a result, in December 2015 Nene was fired as Finance Minister (his first stint), at the apparent request of the Guptas who initially brought in a lackey before the markets exploded in rage. Seven months ago, Nene was back, replacing former Finance Minister Malusi Gigaba who was shifted to the Home Affairs Ministry due to the latter’s generally acknowledgedties to Gupta-related corruption.

To the chagrin of neoliberals and liberals alike, Nene exemplified a problem we can term the “Ramazupta” era of continuity, not genuine change. “Like an albatross around the neck of President Cyril Ramaphosa,” writesjournalist Ferial Haffajee, Zuma’s “long shadow stalks Ramaphosa’s new dawn. The price of state capture was writ large in the policy statement, from the slashing of growth to 0.7 percent – down from February’s estimate of 1.5 percent – to the widening of the deficit, lower tax collections and a projection of skyrocketing administered prices. Electricity prices, for example, will go up by almost double the estimated inflation rate over the medium term.”

The all-powerful credit ratings agencies were unhappy about Mboweni’s deficit/gross domestic product (GDP) rate rising above 4 percent. That alone caused a 3 percent crash in the value of the Rand currency against the US $ within 12 hours of the budget speech. Another junk rating by Moody’s may well follow next month.

This wasn’t supposed to happen, given Mboweni’s excellent historical reputation amongst global investors, e.g. winningEuromoney’s “Central Banker of the Year” in 2001 for taming inflation with what were (and remain) some of the world’s highest interest rates. (Of governments issuing 10-year bonds, only Turkey, Pakistan and Argentina today pay more than SA’s 9.4 percent.)

But things have changed since 2002-08 when a mild boom briefly reached 5 percent annual GDP growth, resulting from looser consumer credit and the commodity super cycle. Unable to grasp the new economic playing field, Mboweni expresseda lackadaisical attitude: “Rising interest rates in the United States of America and a stronger dollar reflect a strong US economy. In the medium term, strong US growth will support export growth.”

Trumpist (and pre-Trump) deglobalisation

First, Mboweni has mistaken what first-hand observersterm a “sugar high” in US growth rates and stock market values, recently fattened by Donald Trump’s massive corporate tax cuts (from 32 to 21 percent). For example, artificially premature purchase orders by US firms were boosted in September because corporates anticipated trade-war tariff increases on US $250 billion of Chinese goods in the weeks ahead.

(South Africa just received minor relieffrom these tariffs, on grounds of trivially low levels of US steel and aluminium imports mainly from ArcellorMittal’s local operations – but Trade and Industry Minister Rob Davies so far remains unsuccessful in negotiating a full country exemption from Trump’s trade tariffs.)

Can Mboweni really count on “export growth” in these circumstances? On top of an anticipated Trump rethink of the Africa Growth and Opportunity Act (which over the last decade boosted US imports from South African metals and auto industries), globalisation trends are reversing, led by the BRICS [Brazil, Russia, India, China and South Africa] countries whose 2017 trade/GDP ratios fell rapidlyfollowing record highs: Brazil dropped from its historic peak of 30 percent in 2004 to 25 percent, Russia from 68 percent in 2000 to 45 percent, India from 56 percent in 2012 to 40 percent, China from 68 percent in 2006 to 38 percent and South Africa from 72 percent in 2009 to 61 percent last year.

Moreover, Wall Street stocks crashedover the two weeks just before Mboweni’s speech, with the S&P 500’s record early-October high based on a 10 percent gain for 2018, simply erased as 13 out of 15 trading days were loss-makers.

But to his credit, Mboweni did at least passingly recognise the risks of what he termed“monetary policy normalisation” – i.e. the gradual winding down of the US Federal Reserve’s 2008-17 low interest rate regime, following the West’s US $27 trillion in bailouts (especially the “Quantitative Easing” printing press) required by banks and corporations during the financial meltdown a decade ago, followed by the Euro crisis.

Contagion from tighter monetary policy, he noted, included emerging markets: “Turkey and Argentina have experienced sharp currency depreciation, rising credit spreads and large capital outflows.” Further turbulence – and maybe the demise of the BRICS blocitself – is likely to accompany Jair Bolsonaro’s neo-fascist rule in Brazil.

In this context of economic chaos, could South Africa be next on the global financiers’ $#!thole list, given the country’s fast-rising US $183 billion foreign debt(7.3 times higher than Nelson Mandela inherited in 1994) and much looser exchange control policies? And if so, isn’t greater state protectionfrom financial-crash ‘contagion’ needed?

Unfortunately, the last 23 years were punctuated by more than three dozen liberalisations of capital controls, most on Mboweni’s watch as 1999-2009 Reserve Bank Governor. Perhaps most foolhardy was the permission given to the largest (non-Afrikaner) companies listed on the Johannesburg Stock Exchange (JSE) to relist in London: Anglo American and De Beers mining houses, Old Mutual Insurance, SAB beer and several others.

Even as recently as Gigaba’s February’s 2018 budget, a week after Ramaphosa took power, Treasury gave institutional investors permission to take another US $34 billion (5 percent of their assets) out of South Africa. Last week, thankfully, Mboweni did not exacerbate this exchange control liberalisation (though he might next February).

Mboweni did, however, hint at further parastatal corporatisation and more “user fees.” For example, he endorsed the state’s hated, ineffectual Johannesburg-Pretoria highway e-tolling dogma, a high-tech system mainly beneficial to an Austrian license-plate surveillance firm, and most harmful to moderate-income black commuters driving from distant apartheid-era townships into the cities. Mboweni also promoted further Public-Private Partnerships to accompany a new US $27 billion infrastructure fund.

On the other hand, Mboweni’s gifts to poor and working-class people last week are surely appreciated. These include making flour and sanitary pads free from the 15 percent Value Added Tax (along with 19 existing VAT exemptions on basic foodstuffs), although Mboweni dashed hopes of adding nappies and poultry to the exemptions because they would cost over US $340 million in annual state revenues.

Those minor concessions aside, austerity is being felt more explicitly, and the ANC’s allies in the Congress of South African Trade Union were scathingabout Mboweni’s “marginal programmes and projects. The statement was a reminder that we still lack a developmental vision, do not have a comprehensive development strategy and totally lack the necessary coordination of activities of various economic agents.”

Of the US $3.4 billion in reprioritised state spending supposedly at the heart of an economic stimulus announced last month, the details remain vague. For example, only US $1.1 billion is allocated to partially restore what even Business Day journaliststermed‘savage’ cuts of US $2.9 billion to basic infrastructure budgets (both municipal and rail transport) in Gigaba’s final budget, eight months ago. Yet the townships and especially the commuter train stations are aflame with anger over inadequate state services.

Perhaps most disappointing from Mboweni in this era of corruption revelations linking multinational corporations to the Zupta empire, he barely mentioned the biggest chunk of wasted money in the budget: procurement. Just two years ago, Treasury’s main regulatory official, Kenneth Brown, observedthat of US $42 billion in 2016 state procurements, US $15 billion was fraudulent expenditure.

As former Finance Minister Pravin Gordhan himself admittedlast year, regarding the 2009-17 era, Treasury had long abetted Zuma’s systematic “rent-seeking. It means every time I [i.e., Zuma] want to do something, I say it is part of transformation. But in the meantime, it means giving contracts to my pals in closets.”

Those contracts persist, even if a few high-profile abusers eventually are busted thanks to Gupta email leaks and (still painfully-slow) investigations. One of the best examples is the ANC’s in-house investment arm, which profited enormously from a US $5.6 billion Hitachi contract to build boilers for two coal-fired power plants, a relationship well knownwhen Treasury successfully sought the World Bank’s largest-ever loan in 2010. Five years later, Hitachi reached an out-of-court settlementwith the US Securities and Exchange Commission – the second-largest ever – after being charged under the Foreign Corrupt Practices Act.

Under Zuma, South African authorities never prosecuted Hitachi or the ANC, nor is such action likely under Ramaphosa. Aside from occasional Competition Commission critiques, local and global corporations have witnessed very little prosecution for fraud in spite of regularly being ranked as the world’s most corrupt bourgeoisieby PwC in its biannual surveys.

Investments? Or corruption-riddled white elephants

Those two 4,800 MW coal-fired power plants (Medupi and Kusile) are the largest under construction on earth, with estimated annual future CO2 emissions of 25 million tons each, not to mention voracious water consumption (10,000 litres/second) to wash coal and cool the boilers. Greenpeace’snew studyshows that in the main area coal is extracted and burned (Mpumalanga), the nitrogen dioxide rates are the world’s highest, resulting in thousands of premature deaths.

Construction on the two are finally nearing conclusion, nearly a decade behind scheduleand around four times more expensive (at US $14 billion each) than originally budgeted. The US $24 billion loan guarantee that taxpayers give Eskom for these boondoggles is for Treasury, a massive ‘contingent liability.’

Failing to consider such big spending commitments means that too many commentators have lost the plot. There are even larger fossil-centric mega-projectson government’s infrastructure to-do listatop the Zuma-RamaphosaNational Development Plan. One is the US $55 billion dig for new coal mines and installation of rail lines and port facilities, so as to export 18 billion tonnes of thermal coal to mainly Asian markets.

That remains the Presidency’s first-priority infrastructure mega-project (Ramaphosa was a former coal company owner). It is plagued by overcharging on locomotives, once a US $5 billion loan from the China Development Bank was secured by the Transnet parastatal, with US $400 million in proceeds directed to Gupta alliesfrom the main contractor, China South Rail.

The second priority mega-project requires another US $17 billion for port-petrochemical complex expansion in Durban, with the fantasy aim of raising annual Durban container throughput capacity by a factor of more than six in the next 21 years, to twenty million. Doubling of oil piping from Durban is already underway thanks to a US $1.5 billion pipeline, originally meant to cost US $420 million. Expansion of container capacity was achieved through Shanghai Zhenhua Heavy Industries cranes purchased with further Gupta bribery.

Two other new fossil mega-projects are in process: a US $10 billion coal-fired power plant (4,600 MW) and metallurgical complex near the Zimbabwe border announcedby Ramaphosa during a trip to China last month; and frackingrigs and pipelines (estimated to cost US $7 billion) in the ecologically-sensitive Karoo desert and Drakensburg mountains.

These massive spends anticipated by state, parastatals and fossil fuel companies put paid to South Africa’s United Nations climate change commitments of reducing emissions. A recent Department of Energy plan that does not yet include the new Chinese coal-fired power plant, but will increase absolute output of fossil energy from the current 30,000 MW to 46,000 MW by 2030, thanks to the new coal plants and fracking gas. Further oil and gas explorationnow underway offshore Durban by ExxonMobil and three other global oil companies are likely to result in even worse emissions in coming decades.

Meanwhile, Mboweni announcedyet another delay in Treasury’s carbon tax. First mooted in 2012, it will in any case be one of the world’s lowestCO2 emissions penalties(at just US $3.20/ton, about 3 percent as high as world-leader Sweden’s), as a result of powerful fossil capital’s ability to fight progress.

The best news is that, unlike Zuma-era budgets, there is no provision for nuclear energy. Had Zuma’s ex-wife won the ANC election for party president instead of Ramaphosa late last year, that gambit may well have cost future taxpayers US $100 billion. The irony is that Nene was compelled to resign due to Gupta-related dishonesty, but the abiding memory we have from his late-2015 firing, is that it was due to resisting Rosatom’s charms and Zuma’s orders.

In contrast, when Mboweni was made a director of the BRICS Bank in 2015, he toldBloomberg that financing nuclear energy “falls squarely within the mandate of the Bank.” So the green-red watchdogging of Treasury will have to ratchet up in preparation for next February’s new budget, when repeated labour and social movement expressions of disappointment will sound hollow if not matched by mass action.

Financial chaos hits the world and Johannesburg

In this difficult context, Ramaphosa invited 1300 corporate leaders to a summit, in order to unveil five-year investment plans. In the economy’s real sector (not financial speculation), genuine expansions of plant and equipment have been scarce since the early 1980s.

The explanation for South African capitalists’ initial, early-1980s “investment strike” was the gold price crash from US $850 to US $250/ounce, which was caused by an unprecedented rise in US interest rates in 1979-80. Within five years, anti-apartheid sanctions plus mass protest plus commodity price doldrums plus South Africa’s foreign debt crisis together caused a 1985 payment default. Exchange controls were also imposed, scaring off foreign investors.

Since then, aside from the commodity boom from 2002-08 and mainly parasitical investments in real estate and financial institutions, there was never much gross fixed capital investment by either public, parastatal or private sectors. This is explained by the fairly close correlation between business confidence and private fixed investment.

Although a bounce occurred after Ramaphosa’s ANC presidential victory and soft coup against Zuma in February, Bloomberg News reportedin August that “the slide from Ramaphoria to Ramaphobia is complete.” The confidence index had soared from 28 in mid-2017 to 45 by early 2018, but then by mid-year was back to 38.

Gross Fixed Capital Investment as share of GDP, 1970-2017: world and South Africa

Source: https://data.worldbank.org/indicator/NE.GDI.FTOT.ZS?end=2017&locations=…

Private Sector Investment and Business Confidence

Source: https://www.resbank.co.za/Lists/News%20and%20Publications/Attachments/8…

In addition to cajoling local investors to have more confidence, Ramaphosa is also searching for US $100 billion in new direct investment from abroad (after a 41percent foreign direct investment decline in 2017). During presidential visits in recent months, China pledged US $15 billion; Saudi Arabia’s bin Salman US $10 billion and the United Arab Emirates US $10 billion. Nothing is known about these deals aside from Pretoria’s shallow back-slapping statements.

Then on October 27, Ramaphosa claimed he had raised another US $20 billion at the investment conference, of which the largest single commitment came from Anglo American Corporation (US $4.9 billion). However, as Haffajee reported, “a lot is repackaged investments and a lot of it is sustaining capita.” The firm is notoriousfor its apartheid-era gold mining – replete with forced displacement and slave-like migrant labour conditions – and when South Africa democratised during the 1990s, Anglo’s financial headquarters was rapidly moved to London, alongside its fraternal De Beers diamond monopoly.

Anglo’s pledge was followed by a collective US $3.4 billion promise from the German-dominated auto industry, yet VW’s 2015 cheating on emissions declarations is one of the main reasons South Africa’s platinum industry is suffering an unprecedented decline. Other big pledgers of at least US $1 billion include Vodacom cellphones, the BRICS New Development Bank(in loans, not strictly speaking investments) and the brutalIndian mining firm Vedanta, whose chief executive Anil Agarwal is also now Anglo’s largest owner.

(However, a Constitutional Court judgment the day before the investment conference may adversely affect future insensitive mining investments by Anglo, Vedanta and others: a poor rural community successfully resistedplatinum extraction on their farm, confirming their “Right to say No!” to mining. The World Social Forum’s “Thematic Social Forum on Mining and Extractivism” will amplify this sentiment at a major Johannesburg gathering next month.)

Setting aside the media hype regarding the promised projects over the next several years, how substantive is the pledged US $20 billion? The South African economy has a US $350 billion annual output of goods and services. It requires more than US $80 billion in annual fixed investments to reach the 23 percent rates of investment to GDP experienced in what is currently a fairly subdued world economy. (The current rate is just over 18 percent investment/GDP, since most retained profits are added to the existing US $100 billion pool of loose cash, which the big corporates refuse to invest.)

Even in a country whose firms are regularly listed (by the International Monetary Fund) as enjoying amongst the five highest profit rates within the advanced capitalist and emerging market economies, fixed investments are simply not as lucrative as financial speculation. Thus South Africa has the notoriety of having the world’s highest-ever national “Buffett Index” rating of stock market valuation to GDP.

But consistent with conditions now ever more common in the world economic $#!thole, the JSE has been crashing alongside stock markets in other middle-income countries. According to Schaik Louw, a leading investment analyst, the chaos is due to the woes of the single largest stock in South Africa, which was one of apartheid’s leading propaganda arms: Naspers (National Press). It owns 31 percent of Tencent, Asia’s largest firm, thanks to a lucky bet: a US $25 million investment now worth more than US $150 billion.

In recent months, explainsLouw, “Chinese internet companies were terrorised by strict regulations and a trade war with the US,”as Tencent was prohibited from marketing Japanese games. The result was a “very wild rollercoaster ride.” (Another major Chinese tech firm suffering similar sell-offs is Alibaba, a Chinese version of Amazon. Its Chief Executive Officer Jack Ma was the keynote speaker at Ramaphosa’s conference.)

Prior to Naspers’ rise and Anglo’s departure twenty years ago, the other South African firm dominating the JSE was South African Breweries. Though now the third-largest listed on South Africa’s stock market, it later ran to London, bought Miller beer and was then swallowed by Anheuser Busch in 2016. Last week, that firm’s share value crashed US $17.5 billion within a few hours after a dividend cut, signalling that in this shitty world economy there is no respite, not even in beer.

A national election approaches next May in which Ramaphosa’s ANC is expected to win with a reduced majority vote – partly because centre-right and left opposition parties are suffering their own crises. Still, notwithstanding on-going rhetorical commitments to land reform (“Expropriation without Compensation!”) adopted last December so as to appease an unhappy ANC mass base, the ideological die has been cast by the week’s two events: Mboweni’s austerity budgeting and Ramaphosa’s pro-corporate commitments.

As Haffajee concluded, the investment conference “means that the policy of Radical Economic Transformation is off the table as policy or practice. This term is Zuma-era coinage and refers to a state-sponsored mish-mash of faux radicalism and old-style Soviet socialism.”

Since taking office in 1994, the ANC government successfully avoided radical policies and practices, with only a few exceptions mainly forced on the politicians by grassroots and shopfloor activists: decommodified AIDS medicines, a modicum of free basic water and electricity, a national minimum wage, and #FeesMustFall tertiary education subsidies. But the rhetoric of ‘transformation’ will continue heating up as the election bears down.

Ramaphosa must next halt the possible splintering of a pro-Zumite rump from the ANC, and slow the rise of the leftist Economic Freedom Fighters, which since its 2014 electoral debut with 6 percent of the vote, has risen to more than 10 percent in the polls. The period ahead will showcase Ramaphosa – a formerly militant trade unionist who in 2012 became best known for his role fronting on behalf of Lonmin during the Marikana Massacre – continuing to fuse the two most obvious characteristics of ANC nationalist-neoliberalism: talk left, walk right.

* Patrick Bond is distinguished professor of political economy at Wits School of Governance, Johannesburg, South Africa. He can be contacted at <[email protected]>