Debt audit: An alternative weapon against state capture

Many African nations are mired in huge debts arising from foreign loans that have hardly benefitted the people. The citizens need to audit these debts. Odious debts should be repudiated, damn the consequences. Moreover, as Thomas Sankara demonstrated in the four years he was president of Burkina Faso, African nations do not need foreign loans to meet the needs of their people.

In the 1990s, post-war Uganda was restructuring the civil service. The country was awash with World Bank funds and donor grants for ‘re-tooling’ public offices, capacity building and rehabilitating infrastructure. At the time, short landings were the order of the day. It is a universal fraudulent practice involving a supplier of goods delivering less than the goods paid for or nothing at all, and then being issued a goods received note by a colluding administrator. The supplier is then paid against the Note. Locally it was called ‘air supply.’

To ensure money was spent on the intended purpose, and in line with international best practice, it was no longer enough for ministries, departments and government agencies (MDAs) to show receipts for public funds spent. It became the rule that they show that the public received value for money. The World Bank produced a value for money (VFM) audit manual laying out the steps for conducting VFM audits. A search on the World Bank website for VFM audits produces over sixty-six thousand results. VFMs are now part of Uganda’s annual statutory audit.

Currently the African Continent is faced with a new hazard. Dwindling traditional sources of commodities have made secondary sources economically viable. Prospecting has made Uganda and Ghana unexpectedly ‘oil-rich’ on paper while the discovery of vast liquid natural gas (LNG) deposits meant Mozambique was able to see a future beyond being Highly Indebted Poor Country.

The inherent financial risk is no longer just that equipment and materials supplied for the new industries may turn out to be vapour, but that the governments of newly rich countries will use the commodities as security for loans so that by the time drilling actually begins, much of the income from the commodities is already owed to Western bankers. As a result, the citizen’s of newly rich countries experience no significant change in their circumstances; service delivery continues to be poor and economic and social indicators remain pathetic.

The popular discourse about the ‘resource curse’ is a distraction. It implies Africans and people of other developing countries are unable to govern themselves. The truth is the dynamic is very simple: the elite in developing countries collude with international banks and foreign investors to exploit developing countries which have weak financial control environments.

This is essentially the background to Mozambique’s debt woes. In that country’s case not only was the borrowing against future drilling of natural gas unwise and unsustainable, it was secret, outside the remit of the officials signing up for it and guaranteed by unauthorized officials, to an extent that would not have been allowed by the constitution of Mozambique even had the guarantors had the authority to issue guarantees.

It seems like an open and shut case; apart from the three officials who took out the loans, Mozambicans owe no debt. The ‘crisis’ was only triggered by the IMF and donors applying pressure on the new government to negotiate with the lenders and thus honour the illegal loans.

|

“The debt in its present form is a cleverly organized reconquest of Africa under which our growth and development are regulated by stages and norms totally alien to us. It is a reconquest that turns each of us into a financial slave—or just plain slave—of those who had the opportunity, the craftiness, the deceitfulness to invest funds in our countries that we are obliged to repay. Some tell us to pay the debt…. [N]one of the debt can be repaid. The debt cannot be repaid, first of all, because, if we don’t pay, the lenders won’t die. Of that you can be sure. On the other hand, if we do pay, we are the ones who will die. Of that you can be equally sure. Those who led us into debt were gambling, as if they were in a casino. As long as they were winning, there was no problem. Now that they’re losing their bets, they demand repayment. There is talk of a crisis. No, Mr. President. They gambled. They lost…. We cannot repay the debt because we have nothing to pay it with. We cannot repay the debt because it’s not our responsibility….” Excerpt from President Thomas Sankara’s address to the 25th conference of the Organization of African Unity, Addis Ababa, Ethiopia, July 29, 1987. |

The Need for a Citizens’ Intervention

As at 14 February this year, S&P’s sovereign bond index listed bonds issued by 13 African countries. A new approach in financial audit is required to address the exponentially larger risk: the debt audit. The goal of the exercise is to discover and make public all loan agreements entered in to and debts incurred by public servants to establish whether the agreements are legal or not.

For each loan, if it is found that the signatories had the authority to sign loan agreements and did not exceed legal limits for loan guarantees, the debt audit then moves on to consider whether the State or only the regime gained any benefit from it. How it was used.

If it was for the regime’s benefit, it is deemed to be odious. An odious debts is one “a despotic power incurs […]not for the needs or in the interest of the State, but to strengthen its despotic regime, to repress the population that fights against it, etc., this debt is odious for the population of all the State. [1]

Banks required to be duly diligent

International best practice is for due diligence procedures to be performed prior to giving loans. Basic requirements would be that banks have the duty to establish that i) the officials concerned are authorized to enter in to the transaction, ii) the borrower (in this case Mozambique will receive the funds and iii) has the means to repay them. Additionally due diligence procedures should be tailored to the known specific risks.

Given that one needs to be more than a fool to qualify as a banker, we have to assume the banks involved in the Mozambican case had the capacity to carry out a reliable feasibility study. As it is, the proposal for the tuna fishing project is regarded as unrealistic in suggesting income from the new industry would outstrip the mature tuna –fishing industry of the Seychelles by a factor of three.

Government officials later admitted the fishing project was merely a front for a military equipment deal. One of the banks issuing the loan had ties to the company supplying the equipment. The banks would therefore would have been aware they were financing an enterprise incapable of yielding any profits. So we can only conclude they were simply gambling on being able to hijack the income from the LNG when it came on stream.

Repudiation of debt

If the debt fails any of the tests for legitimacy the State is justified in refusing to pay it. Debt repudiation is based on the principle that a lender, knowing a loan would not benefit the State is not entitled to make claims for repayment against that State.

Examples include money illegally taken from the Treasury and used to finance wasteful election campaigns and to influence and buy votes. Cash handed out to ad hoc, clandestine ‘security operatives’ hired to cane opposition campaigners during elections and demonstrations would fall in to this category. As would loans that go towards military equipment, tear gas and pepper spray and used to maintain corrupt regimes in power. Also loans used to bankroll elite military units separate from, and better trained and equipped than the regular army, whose job it is to protect the person of the president (Barkan likened them to Ceasar’s praetorian guard).

To protect the lender, repudiation of debt is only legal where the sovereign State can show it derived no benefit from the borrowing AND the lender was aware that this was likely to be the case. The clue is in the secrecy surrounding such loans.

Lenders have the additional advantage of being able to identify from the debt audit report who the actual beneficiaries of such debts were and pursue them for recovery and not the innocent citizen’s of the state.

Beneficiaries of illegal and odious debt would include the recipients of any bribes agents of local and foreign suppliers and contractors may have paid to secure contracts, the cost of which inflate loans and are eventually passed on to the State. The extent of this practice is only just becoming widely known. Last month Rolls Royce paid penalties of US$800 million for bribery in Angola, Nigeria and South Africa as well as Azerbaijan, Brazil, India, China, Indonesia, Iran, Iraq, Kazakhstan and Saudi Arabia. Odebrecht, a Brazilian construction company agreed this month to pay penalties of US$3.5 million for bribing officials for government civil engineering contracts in Angola and eleven other countries.

It should be clear to the reader that bribery for contracts is only a short step away from bribing public servants to invent projects for which there is no need, simply to siphon government funds. There is also a market in projects that do not leave the ground: air supply by ‘foreign investors’.

Interestingly, the international lending agencies that were so vigorous in promoting value for money audits are less enthusiastic, if at all, about the equally important concept of the debt audit. A search for ‘debt audit’ on the World Bank website produce one result, and it is irrelevant.

The Philippines Adopts Debt Audit

In December 2016 the Philippines enacted a law making debt audits a required component of the annual audit of public expenditure. Twenty projects including some funded by loans from the World Bank, the Asian Development Bank and the Japan Bank for International Cooperation will be scrutinized in 2017. Any debt found to be illegal, illegitimate or odious will be repudiated.

The senator responsible for lobbying for this reform, Risa Hontiveros is quoted as saying, “This is truly a historic first. With this provision, we commit to diligently scrutinize the country’s debts if they are indeed in accordance with the principles on promoting responsible sovereign lending and borrowing by the United Nations Conference on Trade and Development (UNCTAD), and repudiate the illegitimate part of our overall debt (emphasis mine)” [2]

There is nothing wrong with borrowing per se but it has been used as a weapon against African and other vulnerable States. The Jubilee Debt Campaign calls it ‘the debt trap.’ [3] A case in point is Ghana, which having benefitted from the debt-cancellation exercise for Highly Indebted Poor Countries (HIPCs) a decade ago is again in debt distress. This in spite of having since discovered oil and enjoying high commodity prices at that time.

Beyond the moral hazard to leaders - the temptation to simply swipe some of the money (and not all leaders are guilty of this) – there is the moral hazard to international lending institutions. Many lend money in the knowledge that because of fluctuating commodity prices, weak financial management, and other circumstances, the borrower is likely to struggle to repay. However the business remains lucrative because the lender is able to hold the borrower’s feet to the fire until they sign away future untapped or even as yet undiscovered commodities. This is the effect of Mozambique’s guarantee by which it renounced “any immunity which it or its property or income may enjoy in any jurisdiction.”

Uganda’s Civil Service Reform Programme

Citizen’s debt audit is vital because lending institutions have an incentive to embellish the facts about their own performance. Take for example the World Bank’s Civil Service Reform Programme in Uganda. Its implementation was a condition for receiving development loans. After it overran the 5 years allocated to it, it was ‘rolled over’ and renamed Public Service 2000. PS2000 was followed by the Public Service Performance Enhancement Programme.

Under each of these projects, attempts were made to implement an integrated personnel and payroll system for the public service. The need grew increasingly urgent as the payroll was used as a vehicle to siphon money out the Treasury using ghost payees. The losses discovered during the Enhancement Programme amounted to Ushs 165 billion (US$ 47 million). Unfortunately the prosecution case collapsed for lack of evidence. However senior officials from the same ministry were convicted of fraud causing a financial loss to government of Ushs88 billion (US$25.1 million).

Regardless of this dismal performance in payroll management the World Bank appraised the Public Service Enhancement Programme in positive terms in 2015 saying: “An Integrated Payroll and Personnel System was implemented in all government establishments, achieving the target.” [4]

However the Auditor General’s Report for 2015/ 2016 says only one of the planned nine modules of the targets was completed. Payroll anomalies which were first identified in a study in the mid-1990s persist: multiple payments are still being made and leavers are not always deleted and there are still ghosts on the payroll. These latter may be related to the fact that the contractor failed to interface the IPPS with the Integrated Financial Management System as required and fake records can therefore be introduced during the manual transfer of data from one system to the other.

US$4 million was spent on the IPPS, mostly paid to the contractor. After this display, the contractor was asked to commence work on Phase II. The final outcome is that because of persistent bugs and its failure to eradicate the problem of ghosts, the entire IPPS is scheduled to be scrapped and replaced in May 2017.

Uganda is a relatively small country with a small public service. It is incredible that a simple payroll system can take over a decade to implement while the country loses billions of shillings in payroll and pensions fraud. There is no justification for the US$4 million government paid the contractor to be repaid to the World Bank. We do not have a complete IPPS. The contractor should be contacted to repay the funds to the lender.

Because the Public Service Enhancement Programme was jointly funded by the World Bank (US$20.3 million) and grants from the British, Irish, and Danish governments (US$16.57). It cannot be immediately established which components of the project were financed by whom. If by the World Bank then the debt is odious to the extent that it was paid before even phase I of the project was complete. If it was financed by grants then there is no debt, and recovery of the loss is a matter for the tax-payers of Britain and Denmark. The Irish Government pulled out citing corruption in the Ministry of Public Service.

Sample List of Illegitimate Debt in Uganda

|

|

Project |

Illegitimate debt |

|

1. |

National Agricultural Advisory Service Partly funded by a US$50,000 loan from the World Bank. It failed, not having increased food yields after 8 years. The President admitted it was corrupt. |

US$50 million |

|

2. |

Tullow Oil Litigation Illegal gratuity paid to 42 government officials on successful litigation against Tullow Oil. The money was taken from the Treasury which is partly supported by World Bank loans |

Ushs 6 billion. Approx. US$1,714,285 |

|

3. |

The National Identity Card First attempt: fraudulent procurement led to re-tendering Second attempt: the contractor produced only 400 cards. |

Original budget Ushs185 billion. Unclear how much was advanced on each of the first two attempts. |

|

4. |

1995: Ministry of Public Service Civil Service Reform Programme Integrated Personnel and Payroll Database – Implementation failed. Contractor paid. |

Sources of finance unknown |

|

5. |

2013: Ministry of Public Service Enhancement Programme Integrated Personnel Payment System Phase I: Only 1out of 9 modules were delivered on time with 3 others being worked on and yet the contractor was paid. Phase II: The same firm was contracted. The entire system is scheduled to be scrapped in April 2017 and a new one procured (Auditor General’s Report 2016) |

US$4 million |

|

6. |

Uganda Land Commission ‘Revised’ under Public Service Enhancement Programme to ensure efficient use of public assets. Outcome: Auditor General’s Report of 2015/2016 shows massive fraud, public land has been snatched from educational institutions, converted to freehold, mortgaged and sold. |

If there is a debt owed for the component of the Enhancement programme that reviewed the Uganda Land Commission it should be repudiated as the outcome is less than poor and the WB evaluation did not reveal that fact. |

|

7 |

Invasion and Occupation of the Democratic Republic of Congo by Uganda Judgment debt awarded by International Court of Justice against Uganda forlooting and pillaging natural resources. The invasion was not sanctioned by Parliament and was unconstitutional. To finance the invasion, government reduced the budgets of all MDAs by 25%. This included those financed and ring-fenced by donors; primary education and primary health. |

US$10 billion

If the invasion was financed in part by WB/IMF or other loan funds, they should be repudiated. |

All these potential savings could go towards making African countries self sufficient. There are two key areas which if they were invested in would rid the Continent of the burden of unpayable debt:

- value addition to commodities and

- irrigation.

Global warming is a threat to the 60% [5] or so of the Continent’s labour force in the agricultural sector which uses traditional farming methods and therefore relies on rainfall. Consider that in the sixty years leading up 1970, Uganda experienced only 3 serious droughts but in the following forty years (1970 – 2010) there were eight serious droughts. [6]

Mali’s cotton industry was virtually decimated after the drought of 2007 followed a collapse in market prices. The prices themselves collapsed because liberalization in Mali, required by the IMF, put Malian cotton in competition with subsidized American cotton – it lost 20% of its value. A radical stop-loss intervention is required.

Yet the IMF, to whom public administration has been surrendered, does not seem to be focused on these interventions. While Structural Adjustment Programmes require civil service reform, they stop short of innovations that would leap-frog Africa in to self sufficiency, such as irrigation and value addition to commodities.Their website yields 1,000 fewer hits for a search on ‘irrigation’ than for a search on one of their pet subjects: ‘results oriented management’, the implementation of which has been problematic.

Potential consequences of debt repudiation

Repudiation of debt could invite retribution of course. Countries could be boycotted by financial institutions. Sanctions could be imposed. It could even attract a full on embargo. One’s mind goes immediately to the potential loss of Unicef vaccination programmes and loans to fix the roads. But not necessarily, the lenders, want – need – the commodities. Their consumption knows no limits. The trick is to add value and obtain a decent price for them, so that we become less and less dependent on loans.

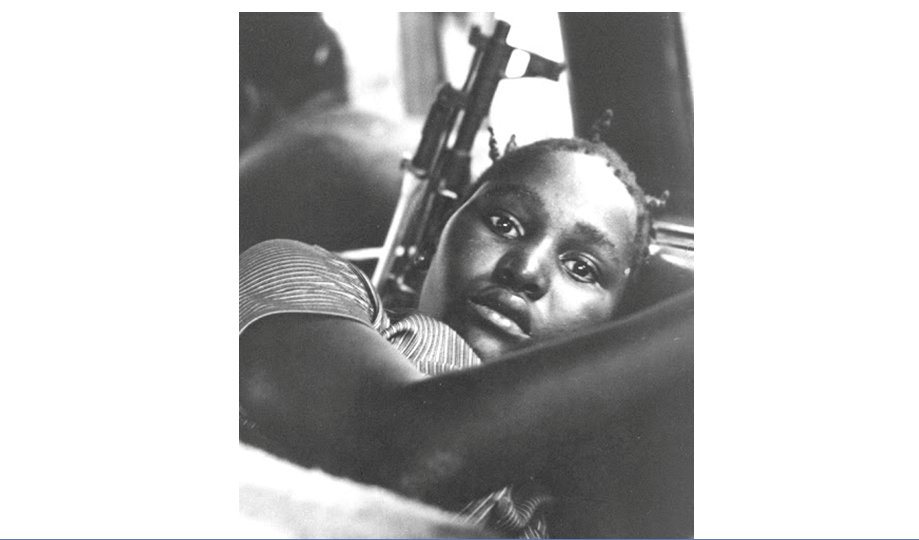

Besides, apart from President Thomas Sankara in Burkina Faso, African leaders are not famous for having tried to be self-sufficient. Sankara’s performance statistics should be required reading for the next generation to show them it can be done: in the four years he was President and without IMF debt; food production per hectare doubled, the infant mortality rate fell by nearly half and school attendance more than doubled. During Burkina Faso’s embargo on debt-imperialism as Captain Sankara dubbed it, he mobilized and vaccinated 2.5 million children in one week, a feat on which even the World Health Organisation congratulated him.

There were consequences, plenty of hardship. It is not an easy choice; the Fatherland or death! as Fidel Castro put it. The option has not been presented to most citizens but I like to think most would choose temporary hardship over being strangled in their beds by Christine Lagarde and Co.

Sankara chose the Fatherland and was quickly dispatched by Blaise Compaoré, backed by the French government. Compaoré assumed the presidency before texting the IMF and getting himself a programme. Many expected an injection of debt would hasten the progress of development: a random search yields these ‘famous last words’ on the topic on the Bertelmann Stiftung, website:

‘The institutional framework for a market economy has improved. Debt reduction following the completion of the HIPC [Highly Indebted Poor Country] initiative provided needed relief. Acknowledging the government’s efforts, the donor community has released new funds. Elections in 2005 will serve as a litmus test for the state of democracy in Burkina Faso.’

Compaoré failed that test and many others to boot. Aided by the French, he fled Burkina Faso a decade after this upbeat report was written, forced out by disaffected women, teachers and youth who had to burn down the house of parliament to communicate the point.

“O país não é vendido! One does not sell the Motherland ….May the Lord care for her, make her stronger… and defend her from all kinds of colonizations."

(Pope Francis on the occasion of Argentina’s Bicentennial Ind